Coverage Solutions Tailored to Your Business

Trade Credit Insurance Pays When A Customer Doesn’t

Can your business afford bad debt?

Most likely, the answer is “no.” That’s why trade credit insurance is a recommended protection for manufacturers, traders and providers of services.

Also known as “debtor insurance,” “export credit insurance” and “accounts receivable insurance,” trade credit insurance is a risk-management tool that protects your cash flow by ensuring you receive funds that are owed to you. It covers your business against nonpayment (after bankruptcy or insolvency) or severely late payments.

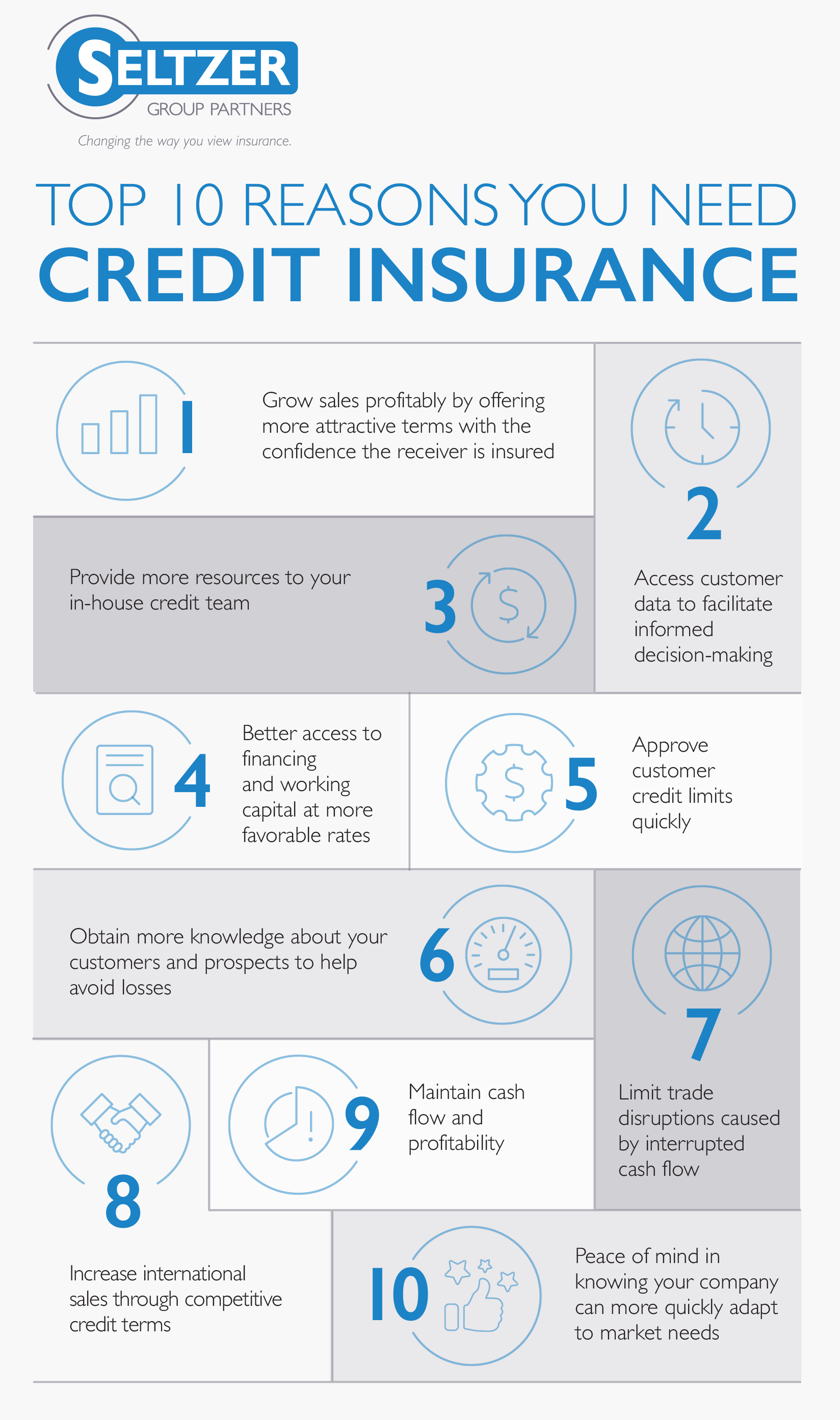

Trade credit insurance can also help your company:

- Gain better access to financing and working capital at more favorable rates

- Approve customer credit limits quickly

- Maintain cash flow and profitability

- Provide more resources to your in-house credit team

- Increase international sales through competitive credit terms

- Offer higher credit limits and more attractive terms to your customers

- Limit trade disruptions caused by interrupted cash flow

- Access customer data to facilitate informed decision-making

As with all types of insurance, there is no one-size-fits-all approach. Many things determine the level and cost of credit insurance that’s right for you, including the size of your credit portfolio, level of risk associated with your customers and location of your market.

Seltzer Insurance Partners will work closely with you to understand your business and your needs to design a trade credit policy that’s right for you. Contact us today to learn more.